Need assistance?

Allow us to help you setup your account. Enter basic details only.

Buy Now For

Suggesed Amount

MF units to be credited in

Select Payment Method

Folio

Select Bank

Disclaimer

Buy Now For

| Fund Name | Amount |

|---|

Would you like to confirm the same?

Check your order status in Order book.

Quick SIP Basket For

Suggesed Amount

MF units to be credited in

Folio

Select Payment Mode

Select Mandate ID

Disclaimer

Quick SIP Basket for

Would you like to confirm the same?

| Fund Name | Category | Amount |

|---|

Check your order status in Order book.

Now transfer money from your bank account instantly

Now transfer money to your bank account

Account Balance

Trading Limit 0

My Orders

00 Successful

00 Yet to Finish

Net Position

00 Open

00(00%) MTM

Portfolio

Total 00

Overall Gain 00(00%)

DP Holding Value

0 Scrips/Schemes

Total Value 00

|

INVEST EASY

For Investors |

TICK

For Traders |

|

|

You might know that Section 80C allows you to save up to Rs.1.5 Lakh per annum by investing in tax saving instruments. However, returns on the amount saved depends on the tax saving scheme you choose. Mutual funds are easy tax saving options.

There are a plethora of tax-saving investment options available in the market and it’s easy to get confused! So, we decided to enlist the best tax-saving investment options under 80C Income Tax Act, 1961. You can compare and choose the saving scheme as per your risk appetite and preferences.

Equity Linked Saving Scheme is an equity-linked tax-saving scheme that gives the dual benefit of tax saving and comparatively high returns than other tax-saving schemes. As it is an equity-oriented product, the ELSS is susceptible to market volatility and the returns may vary with the market performance. Despite this, the ELSS comes out as the best tax-saving investment option, in the context of returns and offer returns ranging 15%-18%.

Also, the ELSS has the shortest lock-in period that allows the investors to re-invest the returns received on maturity of ELSS scheme, further allowing the investment to grow. Anyone who is looking for tax-saving and building wealth correspondingly can opt for ELSS tax-saving scheme as it is eligible for the tax deduction of up to Rs. 1,50,000 under Section 80C, Income Tax Act, 1961.

The PPF is a tax-saving investment instrument and a statutory scheme of the Central Government of India. The scheme comes with the lock-in period of 15 years and has offered returns ranging between 8%-10% that are fully tax exempted. One can contribute to a minimum amount of just Rs. 500 and can go up to maximum Rs. 1,50,000 in a year. The PPF scheme is eligible for a tax deduction of up to Rs. 1,50,000 under Section 80C IT Act, 1961.

The National Pension System (NPS) is one of the tax-saving investment options like PPF where the citizens of India whether resident or non-resident can join NPS. However, to join NPS, the citizen should be between 18 and 60 years. Any contribution to the National Pension System receives tax exemption under Section 80C of Income Tax Act, 1961.

From the year 2016, the investors also offered an additional tax benefit of up to Rs. 50,000 under Section 80CCD(1b) along with existing up to Rs. 1,50,000 exemption under 80C. Unlike ELSS and PPF, one cannot make any withdrawal in NPS before retirement as the NPS comes with a lock-in period of til retirement.

National Savings Certificate is another tax-saving investment option and a fixed income investment scheme by the Government of India that encourages the small to mid-income investors to make investments and save on income tax. It is like PPF, NPS, and ELSS eligible for tax deduction up to Rs. 1,50,000 under the Income Tax Act, 1961 and offer fixed returns of 8%. The NSC scheme comes with a lock-in period of 5 years and anyone who is looking for a tax-saving option to save taxes while earning a steady income can opt for this scheme through the post-office.

Anyone can start investing in NSC as small as Rs. 100 and use the NSC as collateral to Banks and NBFCs for loans.

Bank Fixed Deposits is one of the tax-saving investment options that offer guaranteed returns on investment with the security of the investment as the entire investment amount is locked-in up to the entire tenure. Anyone who has low-risk appetite can invest in banks’ fixed deposit schemes for 5 years.

However, one can only invest in a one-time lump-sum payment which is now allowed for pre-mature withdrawal.

|

TAX-SAVING INVESTMENT OPTIONS |

LOCK-IN PERIOD |

RETURNS |

TAX ON RETURNS |

RISK PROFILE |

|

Equity Linked Saving Schemes (ELSS) |

3 Years |

15%-18% |

Partially Taxable |

High |

|

Public Provident Fund (PPF) |

15 Years |

8-10% |

No |

Low |

|

National Pension System (NPS) |

Till Retirement (60 years of age) |

10.81% |

Partially Taxable |

Moderate |

|

National Savings Certificate (NSC) |

5 Years |

8% |

Yes |

Low |

|

5-Year Fixed Deposits (FDs) |

5 Years |

6.50%-8.25% |

Yes |

Low |

Reference: https://www.paisabazaar.com/mutual-funds/best-elss-funds-for-saving-tax/

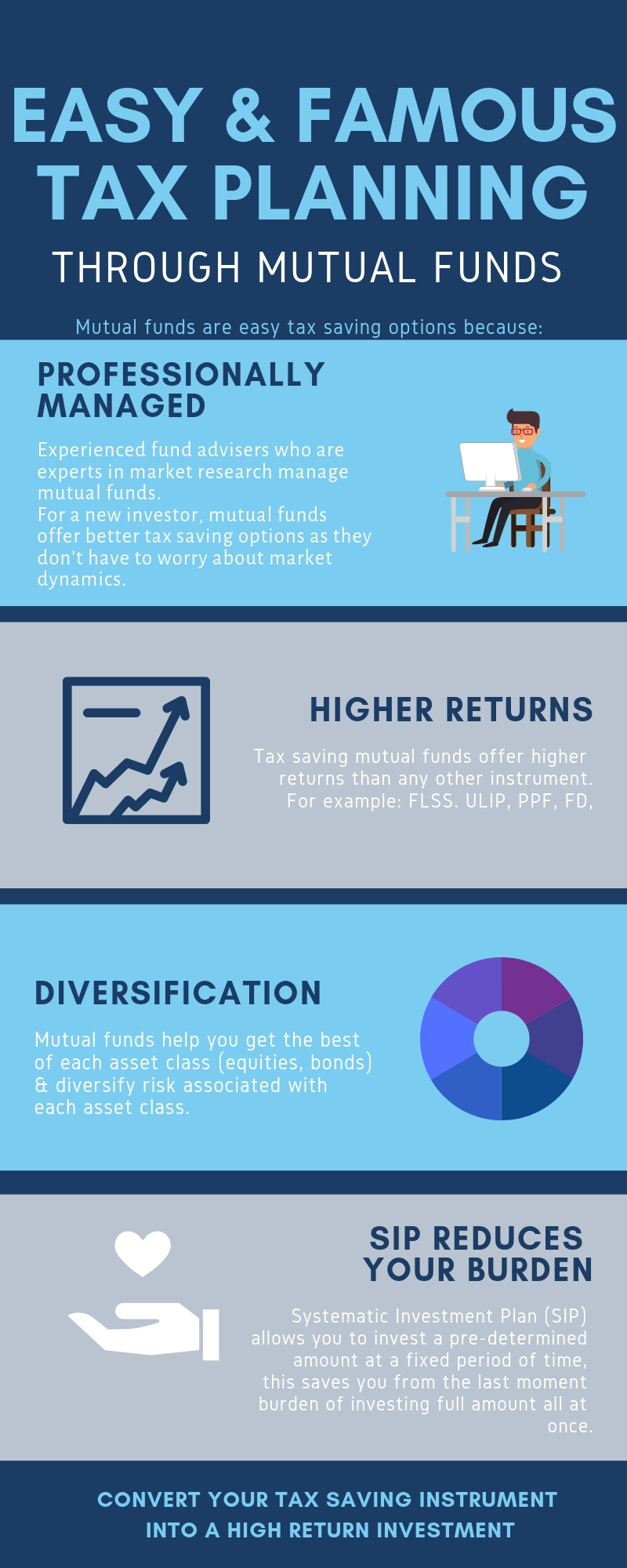

Experienced fund advisors who are experts in market research manage mutual funds. For a new investor, mutual funds offer better tax saving options as they don’t have to worry about market dynamics.

Tax saving in mutual funds offer higher returns than any other instrument. Investment in Equity Linked Savings Scheme (ELSS) provides better returns than other tax saving instruments like Public Provident Fund (PPF), National Savings Certificate (NSC) and Fixed Deposits (FDs).ELSS is a type of diversified fund where more than 80% of the fund is invested in equity. Considering higher returns, ELSS is one of the most recommended tax saving schemes.

Mutual funds help you get the best of each asset class (equities, bonds, treasuries etc.). These funds help you diversify risk associated with each asset class. Even if some stocks in your investment basket are not performing well, the outperforming stocks will balance them, giving handsome returns.

You can choose from a variety of schemes while investing in equities. Tax saving in mutual funds can be done by comparing performance of stocks using the Compare feature.

Systematic Investment Plan (SIP) allows you to invest a pre-determined amount at a fixed period of time. Rather than investing all at once, you can save from your monthly income. Investing certain amount of your monthly income will save you from the last moment burden of investing Rs.1.5 Lakh all at once.

ELSS has the lowest lock-in period as compared to other tax saving instruments like PPF, FD and NSC. Further, ELSS investments don’t have a maturity period. Thus, you can stay invested for as long as you want after your lock-in period ends.

Equity Linked Saving Scheme (ELSS) is a tax saving fund scheme that invests only in equity and equity-related securities. The risks associated with the ELSS funds are similar to the equity funds as they both invest in the equity markets. Despite, the ELSS mutual fund provides the dual benefit of tax saving and relatively higher growth potential compared to other tax saving schemes under Section 80C IT Act, 1961.

With so many options out there, it is not easy to choose the right tax-saving investment option to invest in. It is simply because everyone has different financial goals in life. However, what’s important is to understand that such investments are not only to save tax, but also to accumulate wealth and beat inflation over the long-term.

There are several tax-savings investment options that help with tax exemption under Section 80C and wealth accumulation like FD, PPF, NSC, and NPS but none of them can compete against the ELSS mutual fund which stands out with its dual-benefit – tax exemption and comparatively higher returns than other tax-saving instruments.

There are several benefits of investing in ELSS mutual funds which are as below:

ELSS tax-saving fund can provide you with the capital growth that you needed to achieve your certain financial goals. Since they invest in equities and equity-related securities, the ELSS funds can help you generate high returns and beat the inflation in the long-term.

Anyone who is paying taxes to the government should consider investing in the equity-linked saving schemes (ELSS) as these are one of the tax-saving investment options under Section 80C eligible for a tax deduction of up to RS. 1,50,000 and offer comparatively higher returns than other tax-saving investment options such as National Pension System (NPS), Public Provident Fund (PPF), National Savings Certificate, and Fixed Deposits (FDs).

Also, those who are planning to invest in equity mutual funds primarily for wealth creation should consider ELSS tax-saving schemes as well. It is because of the similarity in the nature of both investment options - both are equity-oriented and susceptible to market volatility. But, in the case of ELSS, you’ll have the tax exemption benefit of up to Rs. 1,50,000 that is not available in common mutual fund investment schemes.

ELSS enables tax savings and helps you convert your tax saving instrument into a high return investment. Start your SIP by investing in mutual funds ; the easiest and famous tax planning option.

Get your reliancesmartmoney.com Account created instantly. Its Easy. Its Free.

Allow us to help you setup your account. Enter basic details only.

OR

Move ahead at your own pace. Modify anytime.

Already a Member? Sign In

Thank You! Our executives will get in touch with you shortly! If you wish to continue the application yourself please visit.

| ||||||||||||||||||||||||||||||||||||||||||||||||||

Thank You! We have received your acceptance to do payin of shares on your behalf in case there is net sell obligation.

Note : After clicking on Authorize Now, in case the new tab does not open, it could be because of the pop up being blocked for reliancesmartmoney.com. Kindly enable the same for a better experience.

| Scrip Name | ISIN | Quantity | Transaction Date | Settlement ID | Action |

|---|

Note:In case authorization is not given within defined time, your shares may go in auction.

Validity (cut off time) of this link is only till T+2, 8:00 AM & this has been attempted post the cut off time. The link for authorization has expired. This will lead to your shares being auctioned.

Please call customer care on 022-62436000 or you may write to us at customer.support@rsec.co.in for any query.

It’s Faster!!

It’s Sleeker!!

Designed especially for the modern investor

Note:After request submission, kindly logout and re-login to check. In case account/segment is still inactive – kindly check after 1 day.

You have successfully authenticated the OTP

You have exhausted 3 attempts at entering OTP. Kindly login again to the system

Your Date of Birth

Your Name

Your User ID will be sent to the above mentioned email ID

Get your reliancesmartmoney.com Account created instantly. Its Easy. Its Free.

Allow us to help you setup your account. Enter basic details only.

OR

Move ahead at your own pace. Modify anytime.

Already a Member? Sign In

Confirm your Security Image

Login To:

Your user ID has been sent on your email ID registered with us.

"Voila! Your password is reset successfully.

Your new password has been sent on your Email ID and Mobile registered with us."

Oh no! Your account is locked.

No worries. Just enter details below to unlock it.

Voila! Your account is unlocked successfully.

No Worries.

Just enter below details and you will be up & running.

Your security question has been reset successfully.

Your first time password has been sent to your email ID

Your User ID:

Your selected image is

Answer any 5 questions of your choice

[ To be case sensitive. Spaces not allowed ]

0 selected

Your password has been changed successfully. Your password will expire in next 60 days.

Answer any 5 questions of your choice

[ To be case sensitive. Spaces not allowed ]

0 selected

Your security questions are changed successfully

Your password has been changed successfully. Your password will expire in next 60 days.

As an Added security measure to your account we need to verify your account details.

Your details has been reset successfully.

Voila! Your credentials have been reset successfully. Your new password has been sent on your email ID registered with us.