Demat account opening procedure

To begin trading in equities, you need to have a: Bank Account, Trading Account & a Demat Account

29 Jan, 2019

Investing in the stock market is a smart way of supplementing your income and generating long-term wealth for you and your family. But, to do so, you need a demat account and a trading account. There are misconceptions around Demat and trading account among people. Most people use the two terms interchangeably; however, they are different and serve different purposes.

In this article, let’s discuss these two accounts, and both of them are necessary to invest in the stock market.

A dematerialised (demat for short) account allows you to hold your financial instruments in an electronic form. It provides an easy and convenient way to hold financial securities in electronic form which is safer than physical shares which are exposed to various risks such as bad delivery, delays, thefts, forgery etc. You can hold certificates of all your financial instruments such as mutual funds , Exchange Traded Funds (ETFs), shares and bonds online. To invest in the stock market, as an investor, you need a demat account.

With the Demat account, there is a significant reduction in cost due to lower printing and distribution and registration of shares which improved the efficiency of registrars and transfer agents. The Demat account has increased the liquidity of shares and ensures faster communication to investors with faster payment in the selling of shares.

A trading account is a unique account that allows you to conduct trading transactions in the stock market. It acts as a link between your demat account and your bank account. However, the Demat account is the one that holds your securities. So, whenever you want to buy or sell shares in the stock market, the transaction will take place through your trading account.

For instance, if you are to buy a share, the money from your bank account will be transferred to your trading account so that you purchase. Once done, the share will be credited to your Demat account. But, if you are to sell a share, the share will be debited from your Demat account and the money will be credited in your bank account.

Both demat and trading accounts are necessary to trade in stocks. However, they are quite different. Here is an example to help you identify the difference.

Imagine you want to buy a carton of milk from a dairy store.

You pick the carton of milk and go to the billing counter. Here, you remove a specific sum of money from your wallet to pay the cashier.

In this example, the money stored in your wallet is similar to stocks stored in your demat account. Removing money from your wallet to pay the cashier is like trading. For this transaction to occur, you need to have a trading account.

As an investor, you need a demat account to deposit and hold your stocks when you purchase them. Think of your demat account as a savings bank account for your shares. You can deposit and remove stocks from your demat account whenever you like; just as you deposit and withdraw money from your bank account as per your convenience.

In comparison, you need a trading account to place ‘buy’ and ‘sell’ orders in the market. It is a requisite to conduct any transactions in the stock market. You can register with any online stockbroking firm to create an online trading account. When you register, you are provided with a unique ID that allows you to trade in the market.

|

|

Demat Account |

Trading Account |

|

Role |

The Demat account is generally used for holding securities, not for transactions. |

The trading account is mainly used for the purpose of buying & selling securities. |

|

Functionality |

Demat account facilitates investors to hold their physical shares in electronic form. |

Trading account facilitates investors to place an order for trading in securities. |

|

Nature |

The Demat account works as the savings account for the purpose of holding. |

The trading account works as the current bank account to sell securities in the market by withdrawing from the Demat account. |

|

Suitable for |

Demat account is suitable for investors who prefer to hold stocks as a long-term investment. |

Trading account is suitable for traders who prefer transactions over a short period of time. |

|

Approval of SEBI and NSDL |

Mandatory |

Not required |

|

Annual Maintenance Charges (AMC) |

Needs to pay |

No AMC charges but the investor have to pay brokerage and statutory charges like GST, STT, turnover tax, stamp duty, and exchange charges. |

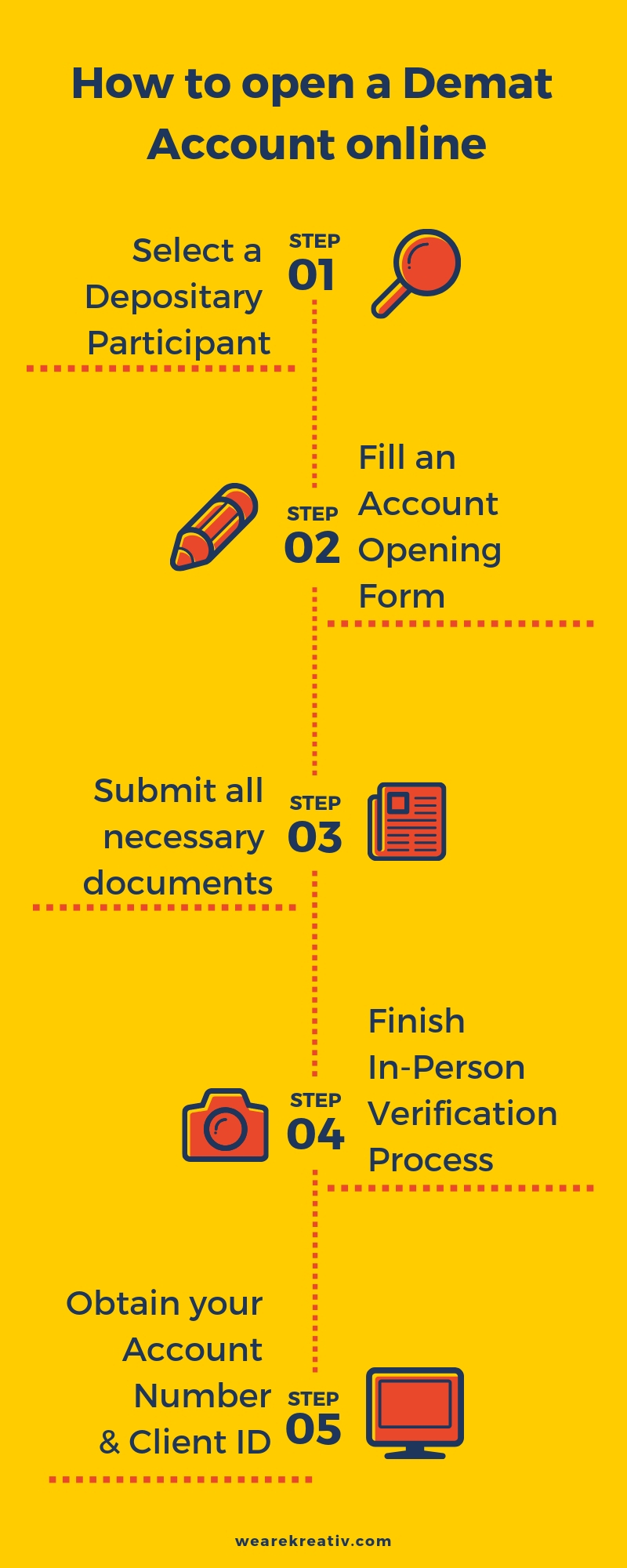

To de-materialize the physical shares in electronic form, you’ll need a Demat account. The Demat account opening involves certain steps that you needed to follow. Investors can either opt for the online or offline process. However, the documents required for Demat account opening remains the same in both cases.

The very first step in opening a Demat account is to select the depository participant (DP). It is an intermediary between depositaries and investor. The two working depositaries in India are –

The next step is to fill up the Demat account opening form and submit it along with the copies of required documents and passport size photograph.

While submitting the documents, in return, you will get a copy of rules & regulations along with the terms of the agreement in opening a Demat account. You need to sign each page of the DP agreement. In the same agreement, you will get the information on the charges you will incur in using Demat account.

Therefore, it would be wise to read all the agreement details and if you have trouble understanding something at any point, you should ask for clarification with the depository participant.

Once the application verification process is done, the DP will provide you with a Demat account number aka Beneficial Owner Identification Number. You can use your account in holding securities with no requirement to maintain a minimum balance.

The procedure of opening a trading account is not different from the procedure of opening a Demat account as mentioned above. Besides, if one is intended to apply for IPOs to hold the shares on the allotment or holding securities over long-term then the Demat account alone will suffice but if one is intended to trade only in futures & options in the derivatives segment, then there is no need of Demat account. Instead, one should go for opening a trading account.

However, if someone is intending to trade in equities – intraday or not, Demat account is a must!

When placing an order for trade, you need to select a product code to identify the category of the order. There are multiple product codes, namely:

Conclusion

A demat account and trading account may be different, but both of them are necessary when you want to invest in stocks. The growth of technology in the stock market means you can now open both a demat account and a trading account easily and quickly. If you are looking to begin your investment journey, open a demat account with reliancesmartmoney.com and chart out your path to success.

Related Articles