Need assistance?

Allow us to help you setup your account. Enter basic details only.

Buy Now For

Suggesed Amount

MF units to be credited in

Select Payment Method

Folio

Select Bank

Disclaimer

Buy Now For

| Fund Name | Amount |

|---|

Would you like to confirm the same?

Check your order status in Order book.

Quick SIP Basket For

Suggesed Amount

MF units to be credited in

Folio

Select Payment Mode

Select Mandate ID

Disclaimer

Quick SIP Basket for

Would you like to confirm the same?

| Fund Name | Category | Amount |

|---|

Check your order status in Order book.

Now transfer money from your bank account instantly

Now transfer money to your bank account

Account Balance

Trading Limit 0

My Orders

00 Successful

00 Yet to Finish

Net Position

00 Open

00(00%) MTM

Portfolio

Total 00

Overall Gain 00(00%)

DP Holding Value

0 Scrips/Schemes

Total Value 00

|

INVEST EASY

For Investors |

TICK

For Traders |

|

|

When we decide to invest, we try to analyse and understand the various investment options keeping the following expectations in mind.

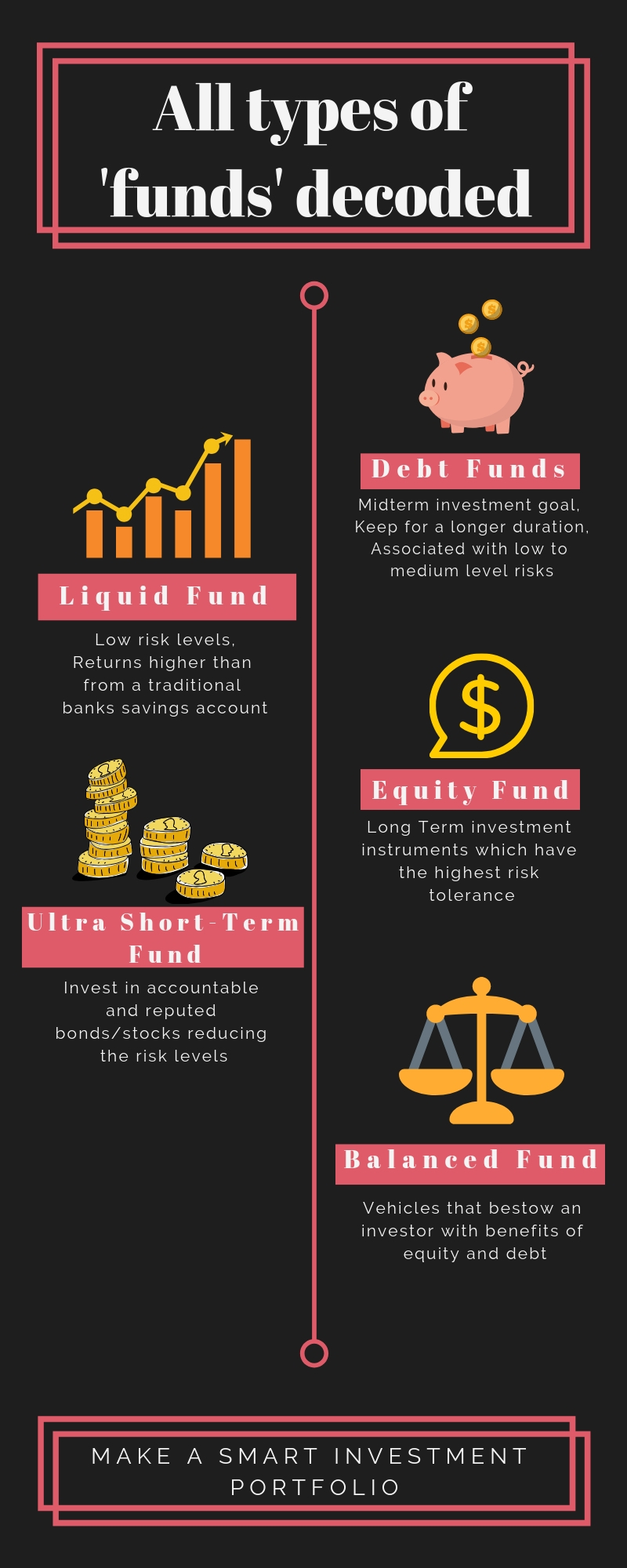

There are various types of mutual funds that you can choose from, based on your objectives. Let’s look at a few types of funds based on the risk levels involved.

These are associated with low risk levels and provide returns higher than from a traditional banks savings account. The average maturity period is of 91 days and the minimum holding period is of two weeks. They come with no exit load (expense given at the time of withdrawing invested capital along with returns). Capital gains are taxable under normal income tax slab if withdrawn before three years. For over three years gains are taxable at 20% with indexation benefit.

These funds invest in accountable and reputed bonds/stocks reducing the risk levels when compared to other . They cater to short term investment goals with returns that are typically higher than liquid funds yet not as high as debt or equity. They have a minimum holding period of three months with a longer maturity period.

These are financial instruments which provide extreme stability and liquidity of investments. They are famously termed as cash reserves and cater to short term investment objectives with low risks. They invest in treasury bills, short-term bank CDs, corporate commercial papers, etc. The maturity period for these funds should ideally be less than 90 days.

These cater to midterm investment goal nevertheless can also be kept for a longer duration and are associated with low to medium level risks. These funds invest in corporate and government securities and bonds in a particular ratio. Corporate bonds accompany certain levels of risks making them moderate-risk-moderate-return instruments. These are highly liquid and should be held for over three years for tax benefits.

These funds invest solely in government securities and bonds which makes them least risky in terms of Income and Debt Funds. Nonetheless they are impacted by market volatility and can witness considerable risk levels in a short term. These are ideal for midterm investment objectives.

Balanced Funds are vehicles that bestow an investor with benefits of equity and debt. An investment can be made in a predefined ratio (60% Equity and 40% Debt) to avail substantial returns than debt alone. The asset which increases in value is sold. For instance, if stock value increases, the fund manager will sell it to buy more bonds, thereby maintain the 60-40 ratio. These are associated with moderate risk levels.

These are Long Term investment instruments which have the highest risk tolerance. They can be further classified into:

Investments are made across sectors like IT, pharma, manufacturing, etc.

Least risky owing to investments in stocks with highest level turnover

Higher risk levels than large-cap and lower than small-cap, these are growing businesses with moderate level turnover

Highly risky since these stocks are with the least level of turnover and cannot be predicted

Invest chunks in each cap thereby diversifying the portfolio

These funds track a particular asset class or index (gold, equity, international indices, and debt) and trade like a normal stock on an exchange. These funds are best suited for investors who cannot master trading abilities and need a safe approach. These replicate performances of their associated indices and provide inflation-adjusted returns.

With reliancesmartmoney.com you can choose any of the available mutual fund investment options depending on your risk-bearing levels to make a smart investment portfolio of your choice to have a sound financial vision.

Get your reliancesmartmoney.com Account created instantly. Its Easy. Its Free.

Allow us to help you setup your account. Enter basic details only.

OR

Move ahead at your own pace. Modify anytime.

Already a Member? Sign In

Thank You! Our executives will get in touch with you shortly! If you wish to continue the application yourself please visit.

|

||||||||||||||||||||||||||||||||||||||||||||||||||

Thank You! We have received your acceptance to do payin of shares on your behalf in case there is net sell obligation.

Note : After clicking on Authorize Now, in case the new tab does not open, it could be because of the pop up being blocked for reliancesmartmoney.com. Kindly enable the same for a better experience.

| Scrip Name | ISIN | Quantity | Transaction Date | Settlement ID | Action |

|---|

Note:In case authorization is not given within defined time, your shares may go in auction.

Validity (cut off time) of this link is only till T+2, 8:00 AM & this has been attempted post the cut off time. The link for authorization has expired. This will lead to your shares being auctioned.

Please call customer care on 022-62436000 or you may write to us at customer.support@rsec.co.in for any query.

It’s Faster!!

It’s Sleeker!!

Designed especially for the modern investor

Note:After request submission, kindly logout and re-login to check. In case account/segment is still inactive – kindly check after 1 day.

You have successfully authenticated the OTP

You have exhausted 3 attempts at entering OTP. Kindly login again to the system

Your Date of Birth

Your Name

Your User ID will be sent to the above mentioned email ID

Get your reliancesmartmoney.com Account created instantly. Its Easy. Its Free.

Allow us to help you setup your account. Enter basic details only.

OR

Move ahead at your own pace. Modify anytime.

Already a Member? Sign In

Confirm your Security Image

Login To:

Your user ID has been sent on your email ID registered with us.

"Voila! Your password is reset successfully.

Your new password has been sent on your Email ID and Mobile registered with us."

Oh no! Your account is locked.

No worries. Just enter details below to unlock it.

Voila! Your account is unlocked successfully.

No Worries.

Just enter below details and you will be up & running.

Your security question has been reset successfully.

Your first time password has been sent to your email ID

Your User ID:

Your selected image is

Answer any 5 questions of your choice

[ To be case sensitive. Spaces not allowed ]

0 selected

Your password has been changed successfully. Your password will expire in next 60 days.

Answer any 5 questions of your choice

[ To be case sensitive. Spaces not allowed ]

0 selected

Your security questions are changed successfully

Your password has been changed successfully. Your password will expire in next 60 days.

As an Added security measure to your account we need to verify your account details.

Your details has been reset successfully.

Voila! Your credentials have been reset successfully. Your new password has been sent on your email ID registered with us.