Need assistance?

Allow us to help you setup your account. Enter basic details only.

Buy Now For

Suggesed Amount

MF units to be credited in

Select Payment Method

Folio

Select Bank

Disclaimer

Buy Now For

| Fund Name | Amount |

|---|

Would you like to confirm the same?

Check your order status in Order book.

Quick SIP Basket For

Suggesed Amount

MF units to be credited in

Folio

Select Payment Mode

Select Mandate ID

Disclaimer

Quick SIP Basket for

Would you like to confirm the same?

| Fund Name | Category | Amount |

|---|

Check your order status in Order book.

Now transfer money from your bank account instantly

Now transfer money to your bank account

Account Balance

Trading Limit 0

My Orders

00 Successful

00 Yet to Finish

Net Position

00 Open

00(00%) MTM

Portfolio

Total 00

Overall Gain 00(00%)

DP Holding Value

0 Scrips/Schemes

Total Value 00

|

INVEST EASY

For Investors |

TICK

For Traders |

|

|

Physical gold vs gold ETFs vs gold SGBs: What should you invest in this Dhanteras

Indians have always had a particular inclination towards gold. It is not only a commodity of prestige and fashion but also a great investment option. Gold is believed to have a good hedge against inflation. Its price tends to rise when the cost of living increases. This means there’s a good chance that your precious metal investments won’t lose its value along the years.

Buying gold is particularly considered auspicious during Diwali. Many people buy gold on the first day of Diwali, which is called Dhanteras. Doing so is believed to bring in good luck and fortune.

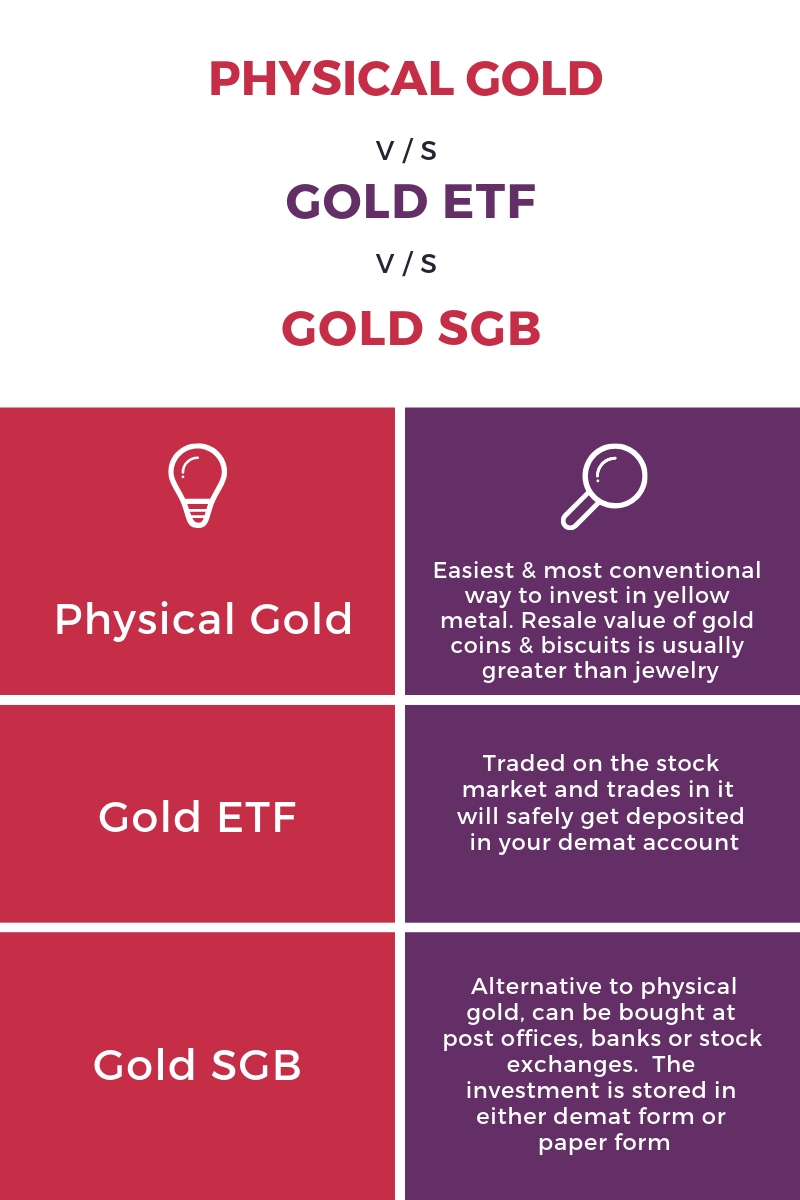

However, these days, gold investments are not limited to physical yellow metal. Physical gold alternatives like Gold Exchange Traded Fund (ETF) and Sovereign Gold Bond (SGB) have gained popularity because of their distinctive features.

So, this Dhanteras, if you’re looking to invest money in gold, consider gold ETF and gold SGB, along with physical gold too. Take a look at all three before you choose your gold of choice this festive season.

Physical gold is a tangible asset with a finite value available in different physical forms like biscuits, coins, and jewellery. For an individual, ‘sentimental value’ plays a vital role when it comes to physical gold. In fact, throughout history, gold has emerged as an unparalleled form of wealth creation asset. Buying physical gold has been the most conventional form of investment which could be in the form of jewellery, coins or ingots. It gives you the added benefit of using your investment as a stylish accessory. However, if you’re buying it solely for investment purpose, you need to be cautious as gold jewellery resale value is comparatively lower than gold coins and ingots. Here are a few advantages and disadvantages of buying physical gold.

Gold Exchange Traded Funds (ETFs) are funds which are traded in stock exchanges and can be bought and sold during trading sessions. Gold ETFs do not have a physical form but are traded almost close to the physical gold price. You can invest in Gold ETFs through Demat account. You can buy and sell it in real-time during trading sessions.

You can buy gold online on reliancesmartmoney.com that offers you multiple gold ETF options.

Sovereign Gold Bond (SGB) is a new type of gold investment introduced by the government. The gold bonds for investments can be purchased at select post offices, designated banks and through stock exchanges. The SGBs are issued by the Reserve Bank of India (RBI) and are traded on exchanges.

|

Parameters |

Physical Gold |

Gold ETFs |

Sovereign Gold Bond |

|

Subscription Limit |

No limit |

Minimum: 1gram Maximum: No limit |

Minimum: 1 gram Maximum: 4kg per person & Hindu undivided family (As per rules for SGB 2018-19) and 20kg for trusts and similar entities |

|

Lock-in period |

No |

No |

5 years |

|

Returns |

Lower than actual return* |

Lower than actual return* |

Higher than the actual return |

|

Liquidity/ Tradability |

Low** |

High |

High |

|

Safety & Security |

Low (Due to higher risk of theft and cheating) |

High (Due to low risk of theft and cheating) |

High (Due to low risk of theft and cheating) |

|

Long-term Capital Gain (LTCG) |

LTCG applicable after 3 years |

LTCG applicable after 3 years |

LTCG applicable after 3 years (No capital gain tax if held till maturity period) |

|

Acceptance as collateral for loan |

Yes |

No |

No |

|

Purity of Gold |

Purity check needed |

High (As Gold ETFs held in electronic form) |

High (As SGB held in electronic form) |

|

Storage Cost |

High |

Low |

Very Low |

As you see, it is worth considering gold ETF and SGB as a means of gold investment this festive season. Like physical gold, these investments have the benefit of capital appreciation. Plus, there are more advantages like long-term capital gains and security too.

Get your reliancesmartmoney.com Account created instantly. Its Easy. Its Free.

Allow us to help you setup your account. Enter basic details only.

OR

Move ahead at your own pace. Modify anytime.

Already a Member? Sign In

Thank You! Our executives will get in touch with you shortly! If you wish to continue the application yourself please visit.

|

||||||||||||||||||||||||||||||||||||||||||||||||||

Thank You! We have received your acceptance to do payin of shares on your behalf in case there is net sell obligation.

Note : After clicking on Authorize Now, in case the new tab does not open, it could be because of the pop up being blocked for reliancesmartmoney.com. Kindly enable the same for a better experience.

| Scrip Name | ISIN | Quantity | Transaction Date | Settlement ID | Action |

|---|

Note:In case authorization is not given within defined time, your shares may go in auction.

Validity (cut off time) of this link is only till T+2, 8:00 AM & this has been attempted post the cut off time. The link for authorization has expired. This will lead to your shares being auctioned.

Please call customer care on 022-62436000 or you may write to us at customer.support@rsec.co.in for any query.

It’s Faster!!

It’s Sleeker!!

Designed especially for the modern investor

Note:After request submission, kindly logout and re-login to check. In case account/segment is still inactive – kindly check after 1 day.

You have successfully authenticated the OTP

You have exhausted 3 attempts at entering OTP. Kindly login again to the system

Your Date of Birth

Your Name

Your User ID will be sent to the above mentioned email ID

Get your reliancesmartmoney.com Account created instantly. Its Easy. Its Free.

Allow us to help you setup your account. Enter basic details only.

OR

Move ahead at your own pace. Modify anytime.

Already a Member? Sign In

Confirm your Security Image

Login To:

Your user ID has been sent on your email ID registered with us.

"Voila! Your password is reset successfully.

Your new password has been sent on your Email ID and Mobile registered with us."

Oh no! Your account is locked.

No worries. Just enter details below to unlock it.

Voila! Your account is unlocked successfully.

No Worries.

Just enter below details and you will be up & running.

Your security question has been reset successfully.

Your first time password has been sent to your email ID

Your User ID:

Your selected image is

Answer any 5 questions of your choice

[ To be case sensitive. Spaces not allowed ]

0 selected

Your password has been changed successfully. Your password will expire in next 60 days.

Answer any 5 questions of your choice

[ To be case sensitive. Spaces not allowed ]

0 selected

Your security questions are changed successfully

Your password has been changed successfully. Your password will expire in next 60 days.

As an Added security measure to your account we need to verify your account details.

Your details has been reset successfully.

Voila! Your credentials have been reset successfully. Your new password has been sent on your email ID registered with us.