Need assistance?

Allow us to help you setup your account. Enter basic details only.

Buy Now For

Suggesed Amount

MF units to be credited in

Select Payment Method

Folio

Select Bank

Disclaimer

Buy Now For

| Fund Name | Amount |

|---|

Would you like to confirm the same?

Check your order status in Order book.

Quick SIP Basket For

Suggesed Amount

MF units to be credited in

Folio

Select Payment Mode

Select Mandate ID

Disclaimer

Quick SIP Basket for

Would you like to confirm the same?

| Fund Name | Category | Amount |

|---|

Check your order status in Order book.

Now transfer money from your bank account instantly

Now transfer money to your bank account

Account Balance

Trading Limit 0

My Orders

00 Successful

00 Yet to Finish

Net Position

00 Open

00(00%) MTM

Portfolio

Total 00

Overall Gain 00(00%)

DP Holding Value

0 Scrips/Schemes

Total Value 00

|

INVEST EASY

For Investors |

TICK

For Traders |

|

|

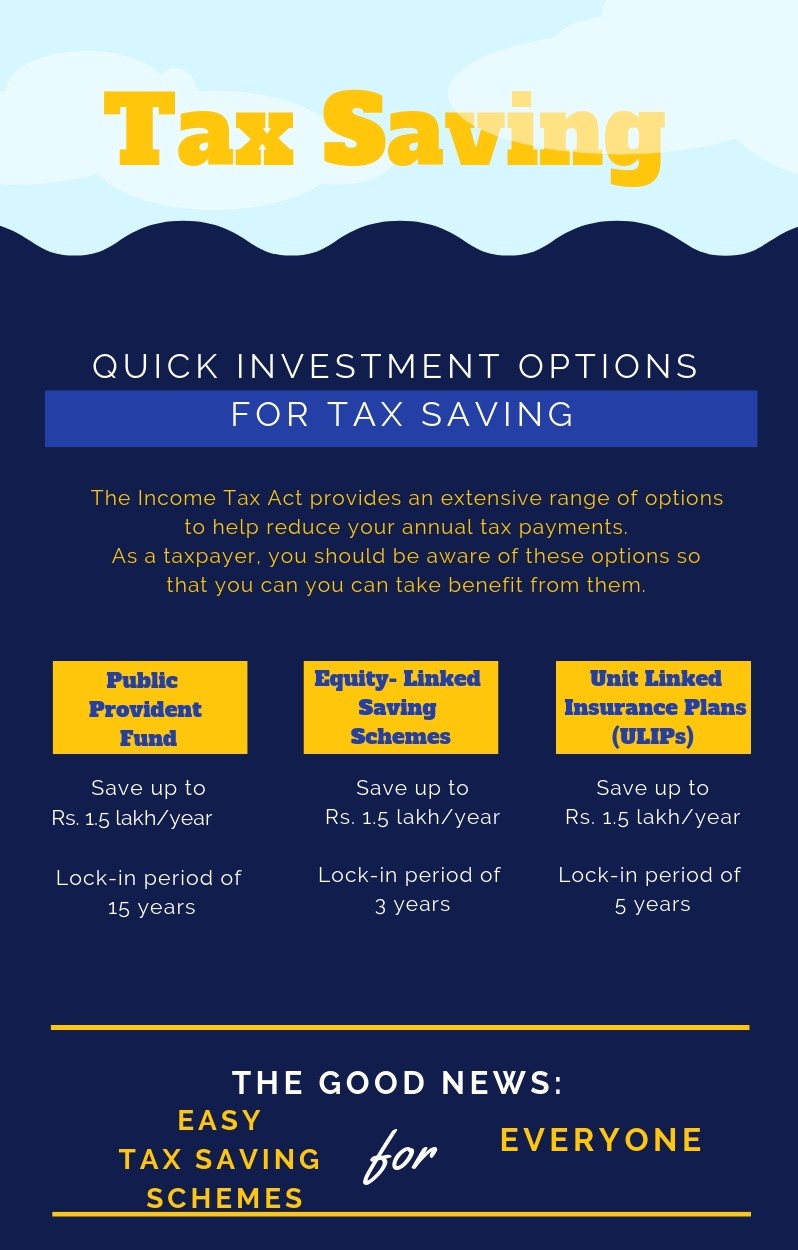

You may hate it, you may like it (highly doubtful though) but you cannot ignore it - Your Taxes. Generally, most people remember their taxes only when the deadline is practically visible to the naked eye. And in a quest to save as much as possible at the last minute, many people tend to make the wrong investment decisions.

The bad news: You can’t avoid tax.

But the good news: There are easy tax saving schemes for everyone.

|

Sr. No. |

Tax Saving Instrument |

Tax Benefit Under Section |

Total Tax Deduction |

|

1. |

Life Insurance |

Section 80C (Premium) & |

Upto Rs. 150,000 |

|

2. |

Health Insurance |

Section 80D |

Upto Rs. 150,000 |

|

3. |

ULIPs |

80CCC |

Upto Rs. 150,000 |

|

4. |

New Pension Scheme |

Section 80CCE / Section 80CCD (1B) |

Upto Rs. 150000 |

|

5. |

Equity-Linked Tax Saving Scheme |

Section 80C |

Upto Rs. 150,000 |

|

6. |

Public Provident Fund |

Section 80C |

Upto Rs. 150,000 |

|

7. |

National Saving Certificate |

Section 80C |

Upto Rs. 150,000 |

The Income Tax Act provides an extensive range of options to help reduce your annual tax payments. As a taxpayer, you should be aware of these options so that you can you can take benefit from them. This not only helps you to save money, but it also enables you to create a better financial plan for you and your family.

3 tax saving options you should definitely be aware of are:

PPFs are safe investment avenues, but the returns you earn on the fund are moderate. On the other hand, ELSS is a tax saving mutual fund that has the potential for high returns. As the name suggests, ELSS are mutual funds investments that invest a significant portion of the amount in equities. This might seem a bit risky but when you invest regularly through Systematic Investment Plans (SIPs) over long-term, your overall risk reduces, and you can benefit from high returns.

Under Section 80C of the Income Tax Act, you can earn tax deductions on investments up to Rs. 1.5 lakh per annum. Also, ELSS funds come with a lock-in period of just three years. This is much lesser than most other tax saving options available to you. This means you have the freedom to move your funds more efficiently based on your financial requirements.

When it comes to tax saving, Public Provident Fund (PPF) is the most popular investment schemes available for investors. It is a safe investment avenue, since the Indian Government issues it. Each year, you can save up to Rs. 1.5 lakh by investing in PPFs. This comes under Section 80C of the Income Tax Act. However, it is important to note that PPFs come with a lock-in period of 15 years. This means you cannot withdraw your investment amount prematurely from the account.

Unit Linked Insurance Plans or ULIPs are a unique investment product because, in addition to life insurance and investment benefits, they also offer tax benefits. Every year, you can avail a tax deduction of Rs. 1.5 lakh under Section 80C on the premium you have paid on ULIPs, during the year. Moreover, in case of death of the policyholder, the amount paid to beneficiaries is not taxable either, under Section 10(10D) of the Income Tax Act.

When you work hard at your job, every rupee earned is accountable. These quick and easy tax-planning options can help you save a substantial amount in tax planning each year. Invest through reliancesmartmoney.com to take advantage of the RoboAssist feature for better investment options.

|

|

PPF |

ELSS |

ULIP |

|

Lock in period |

15 years |

3 years |

5 years |

|

Investment limit |

Rs. 1.5 lakh/year |

Rs. 1.5 lakh/year |

Rs. 1.5 lakh/year |

|

Minimum investment |

Rs. 500/year |

Rs. 500/month |

Around Rs. 2,000 per month [i] |

|

Returns |

8% |

10-15% |

11-13% [ii] |

|

Risk |

Low |

Medium-high |

high |

- https://www.policybazaar.com/life-insurance/ulip-plans/

- https://www.policybazaar.com/life-insurance/ulip-plans/articles/best-ulip-plans/

Get your reliancesmartmoney.com Account created instantly. Its Easy. Its Free.

Allow us to help you setup your account. Enter basic details only.

OR

Move ahead at your own pace. Modify anytime.

Already a Member? Sign In

Thank You! Our executives will get in touch with you shortly! If you wish to continue the application yourself please visit.

|

||||||||||||||||||||||||||||||||||||||||||||||||||

Thank You! We have received your acceptance to do payin of shares on your behalf in case there is net sell obligation.

Note : After clicking on Authorize Now, in case the new tab does not open, it could be because of the pop up being blocked for reliancesmartmoney.com. Kindly enable the same for a better experience.

| Scrip Name | ISIN | Quantity | Transaction Date | Settlement ID | Action |

|---|

Note:In case authorization is not given within defined time, your shares may go in auction.

Validity (cut off time) of this link is only till T+2, 8:00 AM & this has been attempted post the cut off time. The link for authorization has expired. This will lead to your shares being auctioned.

Please call customer care on 022-62436000 or you may write to us at customer.support@rsec.co.in for any query.

It’s Faster!!

It’s Sleeker!!

Designed especially for the modern investor

Note:After request submission, kindly logout and re-login to check. In case account/segment is still inactive – kindly check after 1 day.

You have successfully authenticated the OTP

You have exhausted 3 attempts at entering OTP. Kindly login again to the system

Your Date of Birth

Your Name

Your User ID will be sent to the above mentioned email ID

Get your reliancesmartmoney.com Account created instantly. Its Easy. Its Free.

Allow us to help you setup your account. Enter basic details only.

OR

Move ahead at your own pace. Modify anytime.

Already a Member? Sign In

Confirm your Security Image

Login To:

Your user ID has been sent on your email ID registered with us.

"Voila! Your password is reset successfully.

Your new password has been sent on your Email ID and Mobile registered with us."

Oh no! Your account is locked.

No worries. Just enter details below to unlock it.

Voila! Your account is unlocked successfully.

No Worries.

Just enter below details and you will be up & running.

Your security question has been reset successfully.

Your first time password has been sent to your email ID

Your User ID:

Your selected image is

Answer any 5 questions of your choice

[ To be case sensitive. Spaces not allowed ]

0 selected

Your password has been changed successfully. Your password will expire in next 60 days.

Answer any 5 questions of your choice

[ To be case sensitive. Spaces not allowed ]

0 selected

Your security questions are changed successfully

Your password has been changed successfully. Your password will expire in next 60 days.

As an Added security measure to your account we need to verify your account details.

Your details has been reset successfully.

Voila! Your credentials have been reset successfully. Your new password has been sent on your email ID registered with us.